How Much Do You Know about Your Life Insurance Policy?

If you’re like most people, the answer is, “Not Much.” You probably have a policy and know its value, but past that, the majority of us simply have a hard copy sitting in a file cabinet somewhere in our homes.

The harsh reality is that if you purchased your policy 15, 20, 30 or even just 10 short years ago, your coverage may be a ticking time bomb, ready to explode and leave you uninsured when you need it most.

Significant reductions in interest/dividend crediting result in lower values

Significant reductions in interest/dividend crediting result in lower values

May require higher premiums to assure coverage to specified year/age

May force the policy to lapse sooner if corrective action is not made

So, I developed a program called The Life Insurance Audit™.

This program is designed to ensure that every client has the best possible life insurance solution available in the market today. The audit is an OBJECTIVE evaluation of your current policy, including comparisons to today’s marketplace and pricing.

The program provides a consultative review and results in a professional presentation, and an analysis by experienced industry veterans. In light of the above referenced issues, every cash-value or interest/dividend sensitive insurance policy must be evaluated.

If improvement is possible, we determine which life insurance companies will provide the improvement.

A review of the current product and planning tactics are used to determine if they are in alignment with the goals and objectives. We ask, “Is there a newer product and/or planning strategy available that enables us to achieve the client’s goals more efficiently?”

An evaluation of the current insurance company’s financial stability and an objective review of the carrier’s financials are provided.

The combination of audit elements is then used to develop a recommendation, to either assure a purchase and maintain the current policy, or move to a more optimal solution.

I have relied on him to guide us through the rough waters and terrain of the insurance business. I can personally attest to his integrity, commitment and follow through and conviction to getting things done during the hardest times."

I can personally attest to his professionalism, follow through and spot-on recommendations. I have relied on him and his team for many years, which is a testament to his durability and dependability."

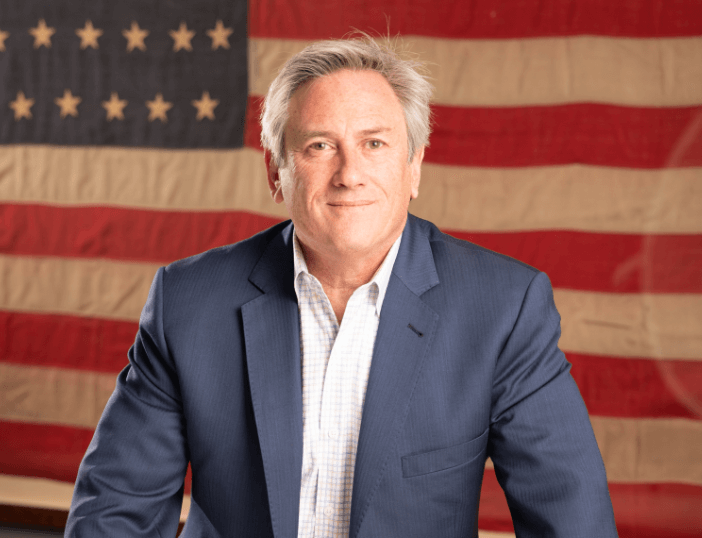

Marty has proven time and time again to be an "advisor" first and a "salesperson" last, a unique combination for any professional. He has gotten quite "grey" fighting battles for me and my clients."

I consider him an industry leader, true professional and of the highest degree of integrity."